Mastering Money: Why Smart Entrepreneurs Separate Business and Personal Finances

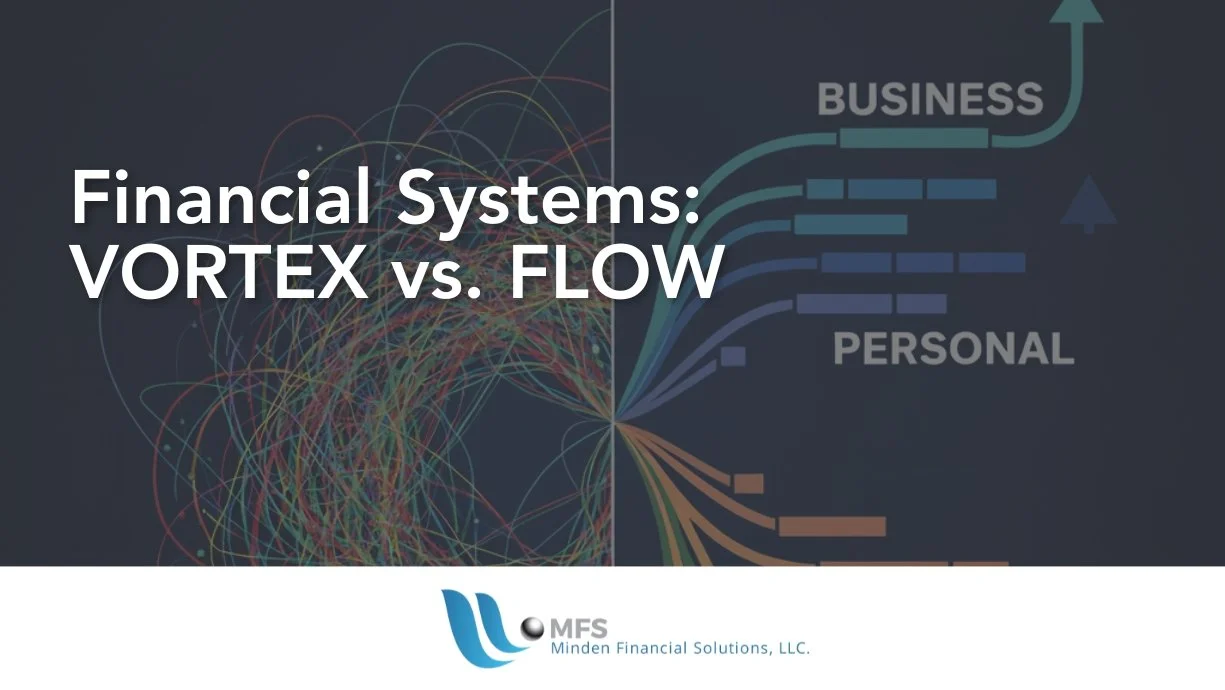

Most new entrepreneurs unintentionally stall their growth by mixing personal and business finances. One account, a few blurred expenses, and suddenly it’s chaos at tax time, missed funding opportunities, and a lingering feeling of financial insecurity.

Smart entrepreneurs set clear boundaries from the start. By separating your business and personal finances, you gain visibility, control, and peace of mind. This article walks you through exactly how to do it, without overwhelm, and introduces a proven system that helps your money work for you rather than against you.

Why Blurring the Lines Hurts Your Business

The emotional cost of financial confusion

When your business and personal spending live in the same account, clear-headed decision-making becomes almost impossible. Every transaction becomes a question mark, such as whether that coffee was for a client or your cousin.

This financial fog feeds anxiety. Many entrepreneurs report feeling like they’re always "behind" on money, not because they’re not earning, but because they can’t tell what income is business versus personal.

How personal habits creep into business decisions

Without a financial firewall, personal habits often override intentional business planning. You might underspend on marketing because the account looks low, forgetting you just paid your rent from it. Or you might overspend on new tools, assuming there's more cash available than there actually is.

These blurred lines limit your ability to build a sustainable and scalable system.

Risk exposure: audits, tax time, and legal consequences

The Internal Revenue Service (IRS) strongly recommends keeping business and personal finances separate. Mixing them can result in compliance problems, especially if you're audited or claim business deductions.

According to the IRS Small Business Tax Center, improper recordkeeping and co-mingled funds are red flags during audits. Not separating finances can also make it harder to track business-related expenses, calculate profits, and meet filing deadlines.

Benefits of Separating Business and Personal Finances

Clarity in decision-making and forecasting

Clean separation means every business transaction tells a clear story. You can track revenue, spot expenses, and confidently plan ahead. Instead of guessing, you are making decisions backed by real data.

Cash flow becomes a system you control, not a mystery. This opens the door to new opportunities, including hiring, expansion, or applying for a loan.

Stronger financial health and scalability

Well-structured finances are foundational to a scalable business. They help you analyze margins, cut waste, and invest intentionally.

The U.S. Small Business Administration (SBA) emphasizes that clear financial systems support long-term growth and resilience. In fact, businesses that separate funds early are far more likely to stay compliant and attractive to investors.

Building investor and client trust

Investors, clients, and collaborators are watching. If your finances look messy, they may question your overall management.

However, when you invoice from a business account, pay yourself like an employee, and show structured reports, you demonstrate professionalism and reliability.

Tools and Systems That Support Financial Separation

Business banking basics

Start with a dedicated business bank account. It does not need to be complicated. Most major U.S. banks offer accounts tailored to small business owners and sole proprietors.

Look for one that:

Integrates easily with accounting software

Has minimal or no fees

Allows you to separate daily spending from tax savings or payroll

You may also want to open a separate business savings account for setting aside taxes or building an emergency fund.

Budgeting and cash flow tools for both domains

With your accounts separated, create specific budgets for each. For your business:

Outline monthly fixed and variable costs

Allocate funds for tools, taxes, and marketing

Pay yourself consistently

For your personal life:

Know your income from the business

Set a lifestyle budget that matches

Keep personal bills strictly outside your business accounts

Tools like QuickBooks for business cash flow are excellent starting points.

Apps and platforms that track everything cleanly

Some popular tools among U.S. founders include:

QuickBooks for accounting, invoicing, payroll, and tax

PayPal Business or Stripe for receiving client payments separately

Fathom or LivePlan for visualizing cash flow and growth

Expensify for managing receipts and expense tracking

Automation reduces administrative time and minimizes the chances of errors or missed obligations.

Common Blind Spots for New Entrepreneurs

Over-relying on personal cards or accounts

Even after opening a business account, it is tempting to use your personal card for small purchases. But every time you do, you undermine your financial clarity.

These transactions create headaches during tax season and muddle your true profitability. Worse, it could lead to underpaying or overpaying your taxes.

Misclassifying expenses

Without a clear understanding of tax-deductible expenses, it is easy to mislabel costs. This can trigger audit flags or result in missed deductions.

Use a detailed chart of accounts and rely on accounting tools to automate classifications. Better yet, hire a bookkeeper quarterly to stay on top of your finances.

Failing to pay yourself strategically

Founders often fall into two traps: either draining the business account to cover personal bills or skipping payment entirely. Both harm your stability.

Instead, treat yourself like your first employee. Set a consistent salary or owner’s draw and align your personal budget to it. This creates predictability and reduces stress.

Bringing It All Together: Structure Without Stress

Treating yourself like your first employee

This mindset is a game-changer. When you view your business as its own entity and see yourself as an employee or stakeholder, financial decisions become easier.

You're not "taking money out" of the business. You are receiving compensation, just like any team member would.

Creating intentional connections between business and life

Even though your accounts are separate, they should connect intentionally. Set up regular, scheduled transfers:

Weekly or monthly paydays into your personal account

Quarterly bonuses or dividends if profits allow

Tax transfers into a separate account

These touchpoints create rhythm and help prevent financial surprises.

Aligning goals with your financial structure

Whether you’re planning a break, buying a house, or scaling your team, your financial setup should support those life goals.

Build a system where business revenue supports both growth and personal wellbeing, without confusion or guilt.

Master Your Money Skills with Financial Intelligence Academy

Learn the skills to master your business finances

Financial Intelligence Academy is an online learning platform designed to help entrepreneurs build strong financial foundations, grow with clarity, and avoid common money pitfalls. Whether you're just starting out or already scaling, FIA gives you the practical education needed to manage business money confidently.

Inside the Academy, you’ll learn how to:

Separate personal and business finances without confusion

Use budgeting and forecasting tools with ease

Build a cash flow system that supports both your lifestyle and business goals

Avoid the common money traps that derail small businesses

With short, actionable lessons and real-world examples, Financial Intelligence Academy gives you the clarity and confidence to make smarter money decisions.

FAQs About Separating Business & Personal Finances

Why can't I just use one account for simplicity?

Because it causes confusion, raises your audit risk, and makes it harder to make data-driven business decisions. One clear business account keeps everything clean and strategic.

What are signs that my finances are too mixed?

If you're unsure which expenses are deductible, missing tax payments, or can’t tell what your actual profit was last month, your finances are likely too blended.

How can I start separating finances mid-year?

Open a business bank account today. Begin routing all income and new expenses through it. Gradually shift recurring payments over, and stop using personal accounts for business activity.

Do I need an accountant to do this right?

Not at the beginning, but having one helps as you grow. Many entrepreneurs start with accounting software and add a professional bookkeeper or CPA when their business scales.

How does separation help me grow my business?

It gives you better cash flow visibility, builds investor trust, and supports strategic planning, all of which are critical for scaling successfully.

Do I need to form a company first?

No. Even if you are a sole proprietor, separating your finances is essential. You can restructure your business later, but the right financial habits should begin now.

Ready to take back control of your finances?

Let us help you build a system that supports your business success and personal peace of mind. Book a call today to get started.